Individual Tax Rate 2017 Malaysia

In malaysia for at least 182 days in a calendar year.

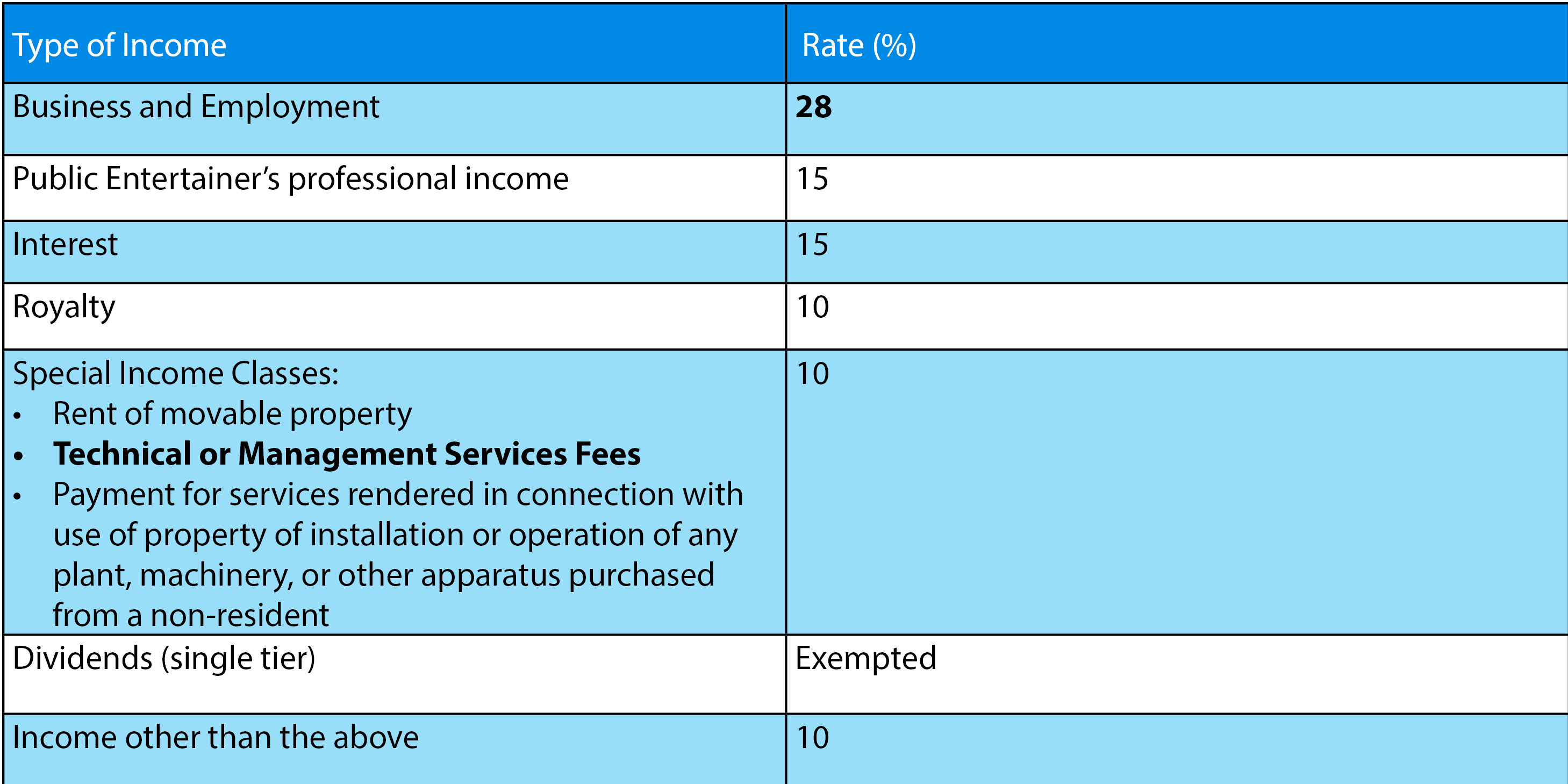

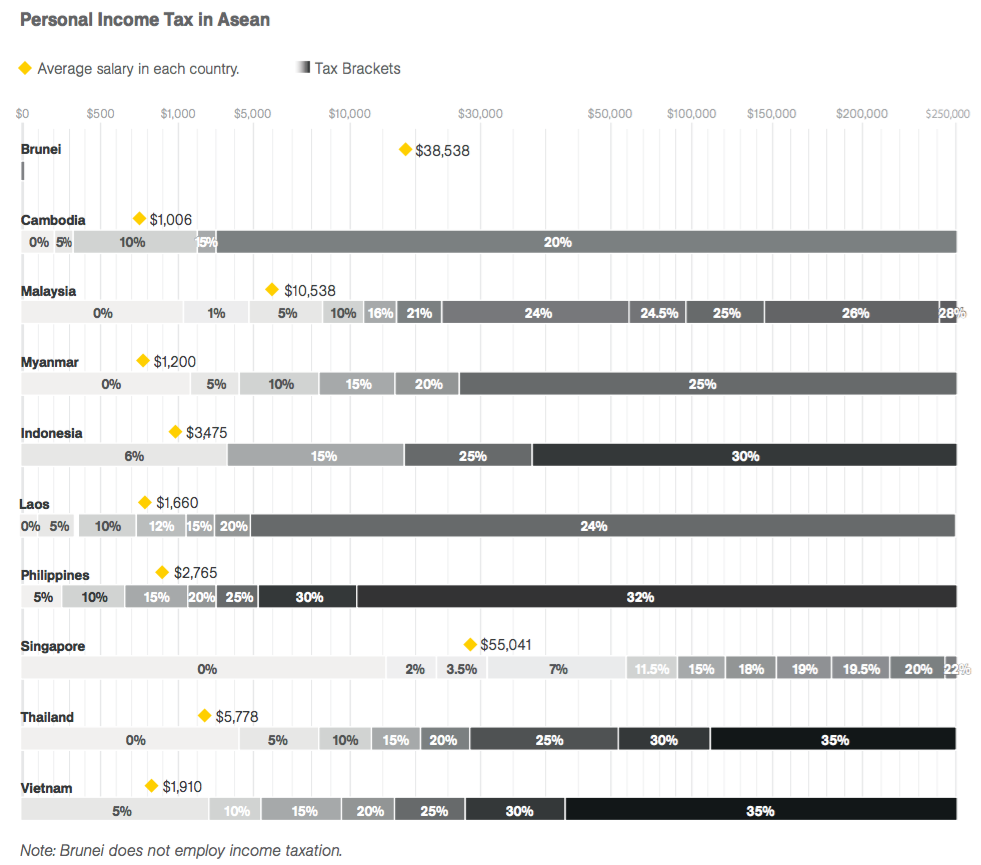

Individual tax rate 2017 malaysia. From ya 2017 the tax rates for non resident individuals except certain reduced final withholding tax rates has been raised from 20 to 22. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. 293 601 406 400. Technical or management service fees are only liable to tax if the services are rendered in malaysia while the 28 tax rate for non residents is a 3 increase from the previous year s 25.

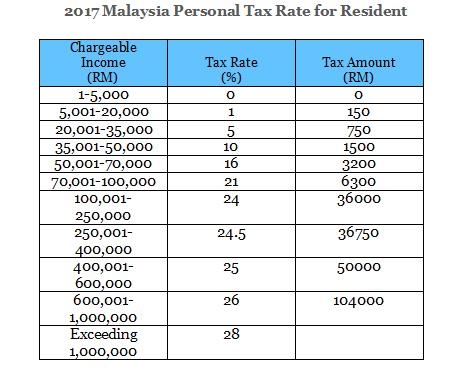

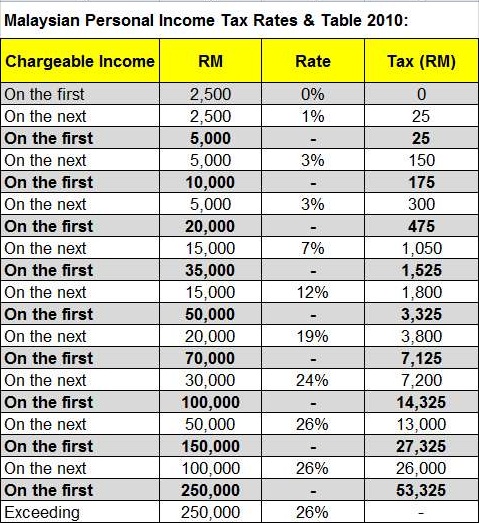

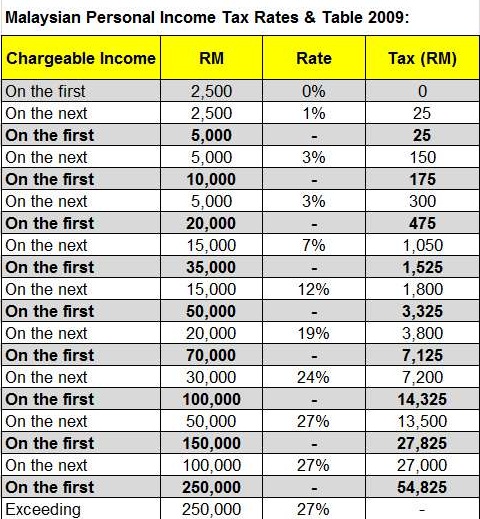

This page is also available in. 2017 tax year 1 march 2016 28 february 2017 taxable income r rates of tax r 1 188 000. Income tax rate malaysia 2018 vs 2017 for assessment year 2018 the irb has made some significant changes in the tax rates for the lower income groups. No guide to income tax will be complete without a list of tax reliefs.

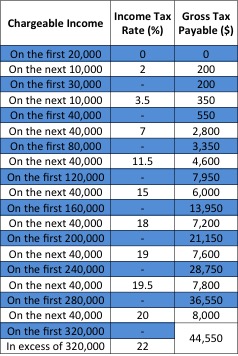

Melayu malay 简体中文 chinese simplified malaysia personal income tax rate. Let s look at the tax rates for the year of assessment 2016 so we can calculate how much tax you. 188 001 293 600. With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income.

33 840 26 of taxable income above 188 000. 2021 tax year 1 march 2020. Not only are the rates 2 lower for those who has a chargeable income between rm20 000 and rm70 000 the maximum tax rate for each income tier is also lower. Rates of tax for individuals.

No other taxes are imposed on income from petroleum operations. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. 18 of taxable income.

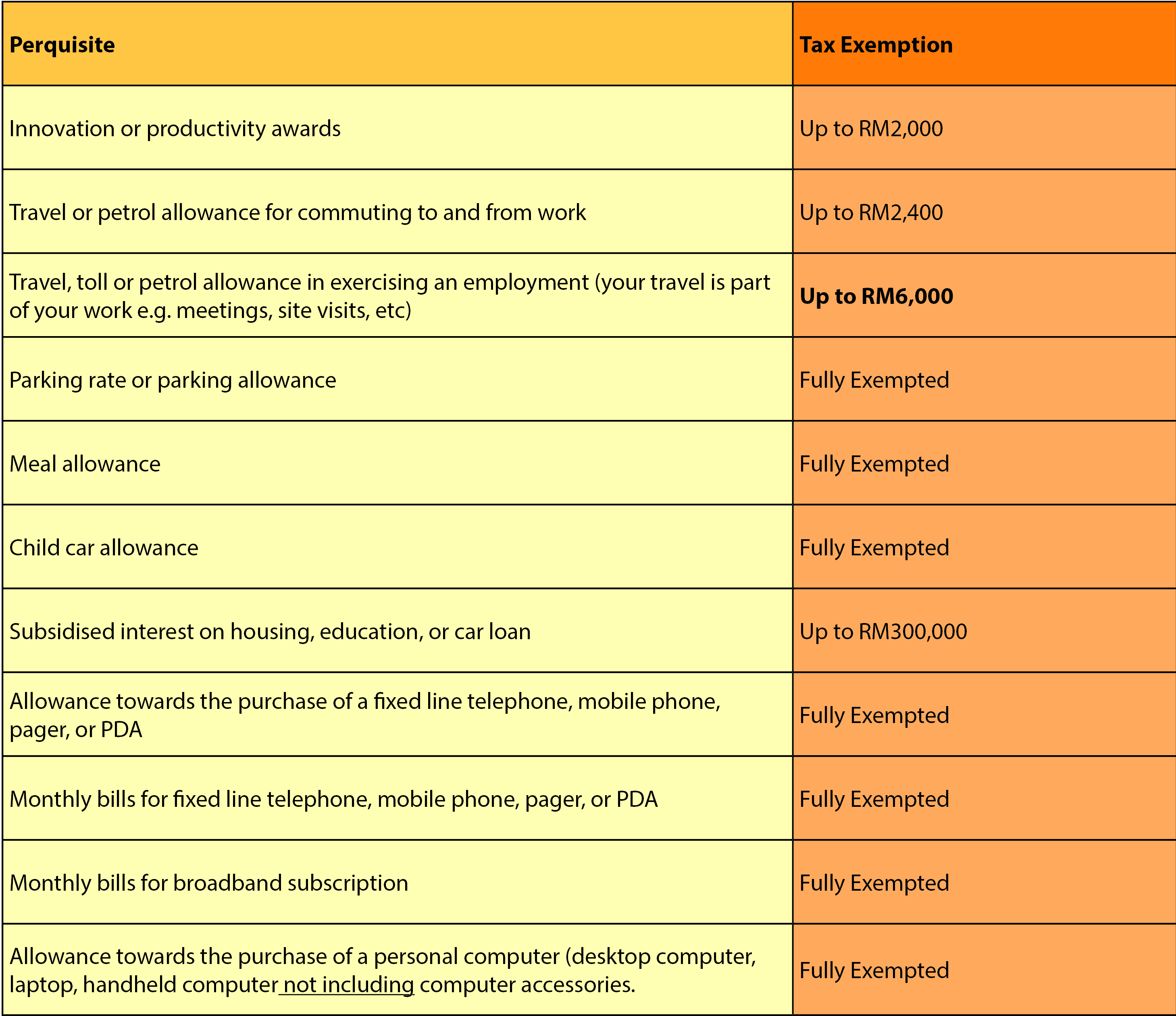

Which is why we ve included a full list of income tax relief 2017 malaysia here for your calculation. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. Pwc 2016 2017 malaysian tax booklet personal income tax tax residence status of individuals an individual is regarded as tax resident if he meets any of the following conditions i e. 1 pay income tax via fpx.

Here are the many ways you can pay for your personal income tax in malaysia. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. This is to maintain parity between the tax rates of non resident individuals and the top marginal tax rate of resident individuals.